The Biggest Real Estate Forecasts for the Second Half of 2025

Wait… how are we already halfway through 2025?!

Time really flies when you’re keeping up with the real estate market. 🏡

As we head into the second half of the year, one question keeps popping up from buyers and sellers alike:

"What’s next for the housing market?"

While no one has a crystal ball, experts at Fannie Mae, Zillow, NAR, MBA, and more have all weighed in with their updated forecasts—covering everything from home prices and mortgage rates to what we can expect for the rest of the year.

I’ve pulled together the big-picture highlights from their mid-year outlooks and added a few thoughts about what this could mean for us here in the Greater Milwaukee area.

🏠 Home Prices: A Gentle Rise (With a Few Exceptions)

Most experts agree: home prices are expected to rise—but slowly. Depending on where you live, you may even see a slight dip.

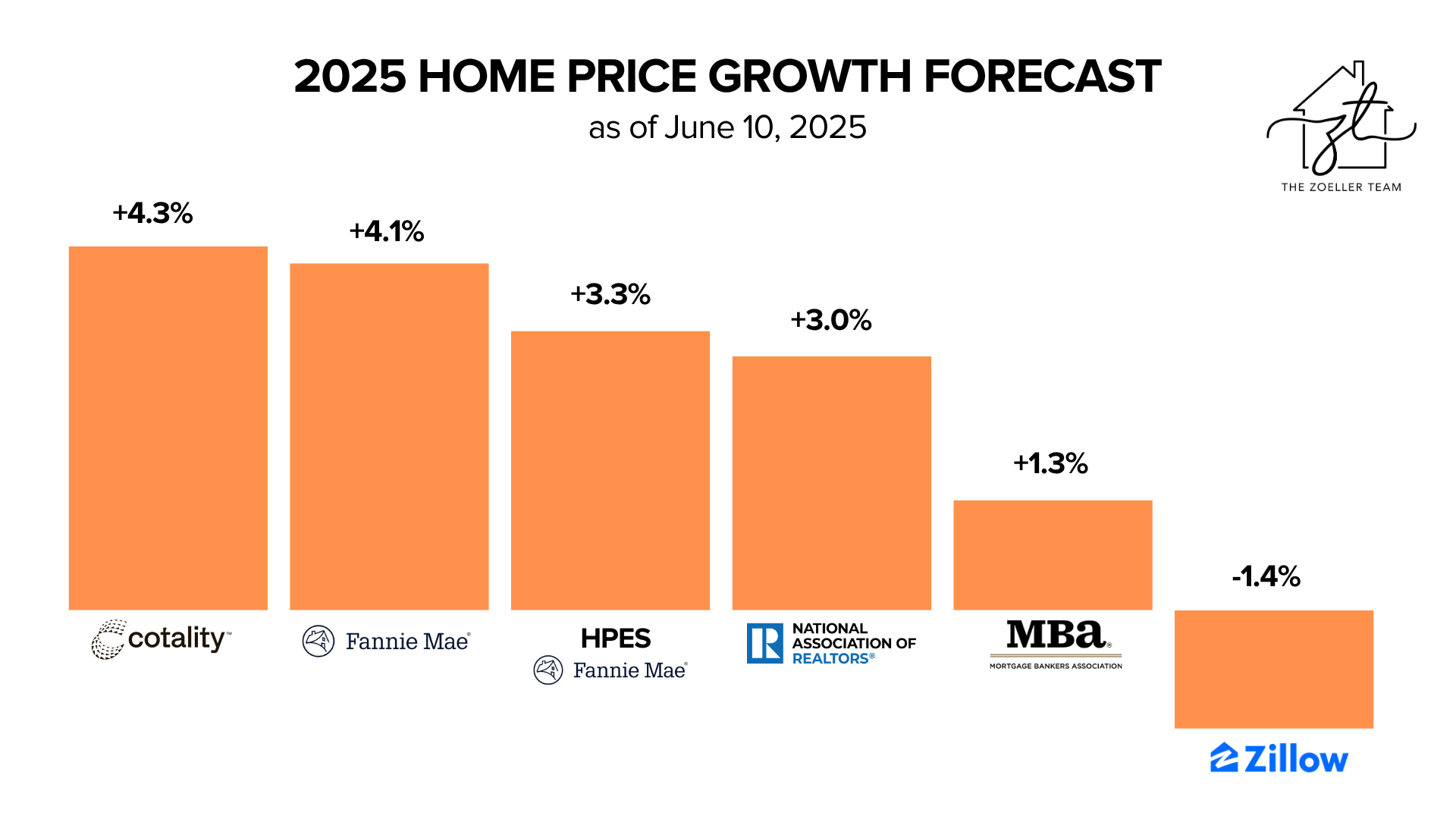

Here’s what the major players are predicting for 2025:

Cotality: +4.3% from April 2025 to April 2026

Fannie Mae: +4.1%

HPES: +3.3%

NAR: +3% in 2025 and +4% in 2026

MBA: +1.3% in 2025 and under 1% in 2026

Zillow: -1.4% (a slight improvement from their earlier -1.9%)

Some of the markets that overheated in recent years—like parts of Florida, Texas, and Hawaii—are seeing price adjustments. Meanwhile, more affordable areas (especially in the Midwest and Northeast) are staying strong.

❗Here in the greater Milwaukee area we are still seeing prices climbing. We are still seeing multiple offer situations on houses that are priced right, but buyers are still able to negotiate contingencies (like inspections) into their offers in many situations.

🔁 Existing Home Sales: Slow and Steady Wins the Race

Good news—sales activity is climbing! But the rebound is going to be a gradual one.

Here’s what the pros are projecting for existing home sales in 2025:

NAR: +6% (with an 11% jump expected in 2026)

Fannie Mae: +4.4% (about 4.24 million homes)

MBA: Around 4.3 million

Zillow: +1.4% (4.12 million homes)

With more homes coming to the market and rates slowly trending downward, buyers and sellers are starting to re-engage.

❗Listings are up by 5% in Ozaukee County since May of 2024.

💸 Mortgage Rates: Relief, But Not a Freefall

Let’s be real—if you’re holding out for sub-5% rates, you might be waiting a while. But the trend is moving in the right direction.

Here’s where the latest mortgage rate predictions land:

MBA: 6.6% by Q4 2025; 6.3% in 2026

NAR: 6.4% later this year; 6.1% next year

Fannie Mae: 6.1% by the end of 2025; 5.8% in 2026

As NAR’s Chief Economist Lawrence Yun put it, mortgage rates are the "magic bullet" that could really get the market buzzing again—especially for first-time buyers.

❗The interest rates have not been stopping our buyers from looking and writing offers. The Zoeller Team has not personally been hearing as much “I am waiting for rates to drop” as we were hearing in years past. I think buyers know the rates aren’t taking some drastic drop anytime soon, so if they need a house they need a house and are going to keep moving forward.

So, What Does All of This Mean for You?

Here’s the short version:

📈 The market is recovering—just not overnight.

💰 Prices and sales are ticking upward, but gradually.

💡 Mortgage rates will likely stay above 6% for now, so budgeting wisely is still key.

The big thing to remember? National trends don’t always reflect what’s happening in your backyard. Local inventory, pricing, and buyer behavior can vary neighborhood by neighborhood.

If you're wondering how all of this plays into your personal real estate goals—whether buying, selling, or just keeping an eye on the market—I’d love to chat. Let's look at what’s happening right here in the greater Milwaukee area and what that means for you.